By adaptive - May 16th, 2016

The National Retail Foundation gives U.S. retailers a mixed report card for their multichannel efforts. And as Susan Kuchinskas reports, there are plenty of missed opportunities.

U.S. retailers are making steady improvement in their ability to serve customers in a holistic, multichannel way, according to the National Retail Foundation's Holiday FitForCommerce Omnichannel Retail Index. But they also backslid on some best practices.

To create the index, NRF mystery shoppers evaluated 120 top retailers across 20 verticals; 100 of them operated physical stores. This is the second NRF FitForCommerce report to be released; it follows the first Summer Index, released in October 2015.

Part of the difference can be attributed to the special demands of the holiday shopping season, according to Vicki Cantrell, senior vice president, communities, NRF. During the holidays, people are buying a greater volume of things for more people in a short time period. Therefore, she says, "There's much more noise in the industry vying for the customer attention. Because there is so much competition out there, and you are vying for customer eyeballs, you are going to put an intense amount of marketing into how to get their attention."

That sometimes translates into less attention to the actual customer experience, especially when it comes to providing mobile services and integrating them into the overall retail environment.

Up and down

The NRF's mystery shoppers looked at more than 200 features and functions across web, mobile and cross-channel. Overall scores improved 4.8 percent, based on criteria including:

· Providing a shared cart for online and mobile shopping

· Sending mobile-optimized email

· Letting customers buy online and pick up in-store

· Letting site visitors refine search results on a category landing page

· Providing a store lookup function on category landing pages or product pages

At the same time, retailers had dropped some NRF best practices. Use of interactive kiosks and displays was down 12 percent from the summer, and sales associates offered buy-in-store and ship-to-home services 14 percent less frequently.

Cantrell notes that retailers typically add temporary staff to handle the holiday rush, and it's difficult to train temps adequately, so that might account for the slippage in sales-associate communication.

Cost/benefit balance

Some of the NRF-recommended best practices can be costly. For example, while 47 percent of consumers told the NRF that free shipping was the most important factor in merchant selection, many retailers continue to set minimum order requirements in order to get free shipping.

"This is one of those needles you have to look at constantly when you're in retail," Cantrell acknowledges. "It's a balancing act between the workforce and carrier pricing -- and every change you make can move the needle. … Shipping always erodes profits. The threshold makes it less eroding."

Mobile is key to satisfaction and conversion

Retailers have gotten the message that the mobile channel is vital for customer satisfaction and also a strong source of sales. Mobile devices delivered 44 percent of traffic and 31 percent of all online sales in 2015, according to the NRF. Retailers continued to invest in the mobile channel, leading to an overall 20 percent lift in the score compared to Summer 2015.

A survey on mobile shopping trends by market research firm Toluna found that for browsing and product research, 76 percent of consumers used the online or mobile channels. When it came to purchasing, however, 76 percent said they preferred to buy in a store.

The mobile experience itself needs to be excellent – and there are too many bad apps out there, according to Joe Kleinwaetcher, vice president of innovation and design at payments company Worldpay. He says, "If you can't do it well, find a different way, like a loyalty program. Don't come to the game unless you come with quality."

Kleinwaetcher says retailer apps should have five attributes:

· Geolocation to provide store and product locations

· A good search function

· Clean design that's fast and easy to use

· In-app checkout with biometric authentication and mobile-wallet compatibility

· Connection to social platforms

Letting mobile users quickly check reviews on social media sites is the best way to get consumers to buy, Kleinwaetcher adds, because we trust reviews more than retailer information.

The growth in mobile wallets will aid retailers in providing a better experience to consumers, says Sergio Barrientos, chief strategy officer for ad agency M8, because they provide data that can be used to track locations, behavior and patterns.

Barrientos says the next generation of retail experience will allow consumers to visit the store, scan products with their phones, complete the purchase via the phone and then have it delivered. "Imagine an Uber experience in a retail store," he says.

Big fat opportunity

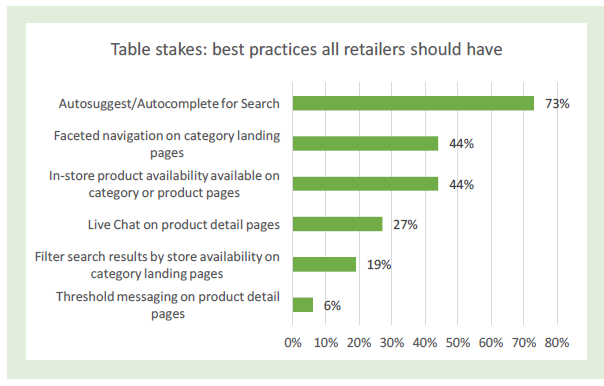

Visibility into product availability is another competitive differentiator. The NRF found that 74 percent of customers are likely to come into a store to buy an item if they know in advance it's in stock – but only 19 percent of retailers in the Index let consumers refine search results to show only what is available in the store. Moreover, only 44 percent provide store availability lookup on category or product detail pages. "This is a huge opportunity," the report says.

Source: NRF

Ramping up

There's evidence that retailers are moving to take advantage of these opportunities. A study by Unacast, a provider of back-end proximity services, found that one third of top U.S. retailers have planned major beacon projects for this year. Retailers are using proximity applications not only to send push notifications, but also to enhance customer experience, service, efficiency and loyalty – exactly what the NRF recommends.

Unacast also calculates that 80 percent of all smartphones are now passively beacon-enabled, which could increase usage of proximity marketing, because shoppers don't need to download and open specific apps in order to get alerts.

The NRF's Holiday Index was released in April because now is the time for retailers to up their game for the 2016 holiday season. "This is ongoing and critical all year long for retailers," Cantrell says. Right now, retailers should be planning their big pushes, she advises. "Holiday season starts earlier and earlier."